Today many of us are living longer. What does that mean? It gives us more time to enjoy life, friendships, family and other pleasures. On the other hand, what happens if we find our loved ones unable to manage on their own?

Families are far more spread out geographically than they used to be. Many would-be family caregivers are working long hours outside the home and/or caring for their own children. Those adults in the “sandwich generation” may need to consider helping their loved one move to assisted living—or even hiring someone to help provide care in their loved ones’ home.

Future Needs

What most older adults want and need is to have choices about where to go and what to do, should the time come when they can no longer live independently. Many people think private health insurance or Medicare pays for extended care in their homes or in assisted living communities. Unfortunately, that is not true.

Typically, health insurance pays for doctor and hospital bills. Medicare covers skilled care for periods up to 100 days, but if care is needed for more than 100 days, you have to spend down your assets before Medicare pays for more. Even then, you have less choice about the kind of care you receive.

Long-term care insurance can give much more control over life and health needs.

- Long-term care insurance helps maintain independence and dignity

- It can help protect retirement assets or income

- It helps relieve financial and caregiving pressure

- Care insurance can increase the ability to choose from different options for care and living

Tips for Researching Long-Term Care Insurance

Consult a qualified professional before you purchase long-term care. Take time to research options and take a look at the following tips:

Consider Shared Care

Spouses or other people who lived together can purchase policies that are linked, allowing benefits to be used by either person while saving money on premiums.

Work with Someone Who Represents Multiple Companies

Look for an agent who doesn’t recommend the same insurer to everyone. Available plans vary greatly among insurance companies, and premiums for the same type of coverage can be all over the map.

& Dignity

Set a Deadline

The older your loved ones are when buying long-term care insurance, the more expensive it will be. Set a deadline for purchasing and do it before the age of 65—preferably ten or fifteen years before that, if you can.

Buying long-term care insurance can help protect family members from having to give up their jobs and lives to provide daily care. Taking action now can help make sure that you have the resources to pay for the kind of care you and your loved one wants and needs.

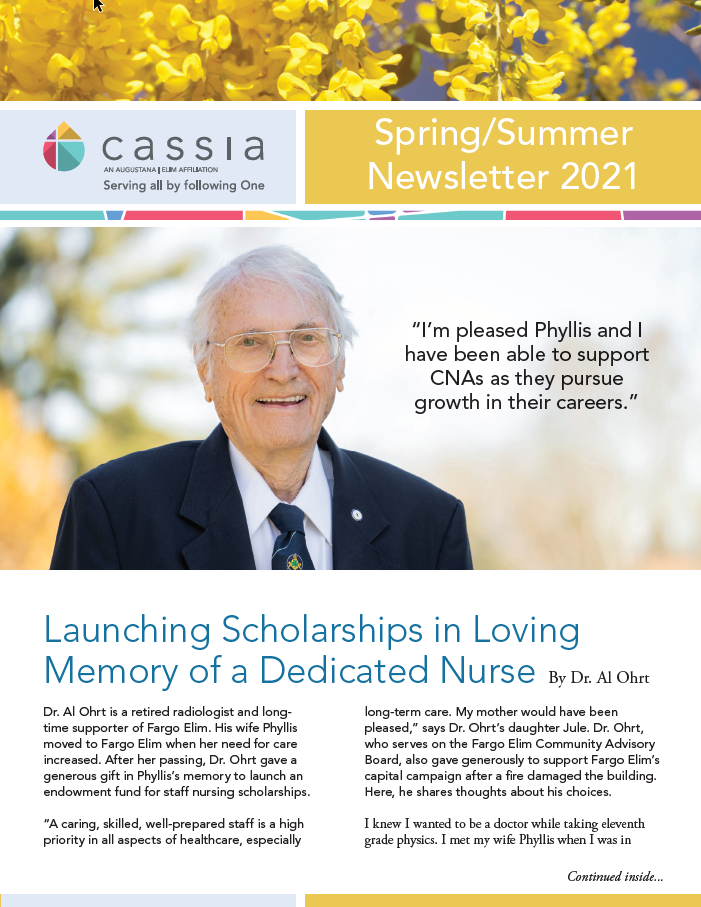

About Cassia

In 2018, Augustana Care and Elim Care came together to form Cassia. We are a faith-based, nonprofit organization with over 200 combined years of experience providing housing, health care and community services to older adults and those in need. In addition to several Minnesota locations, Cassia offers communities and services in Colorado, Florida, Iowa, and North Dakota. Residents in Cassia communities can find skilled nursing, assisted and independent living, memory care, adult day services and rehabilitation.